GMT Capital

Women entrepreneurs make an important and ever-growing contribution to African economies through the various businesses they own and run. This is despite socio economic challenges that women face as they handle both domestic and professional responsibilities. Even under circumstances where the playing field is not level, their determination, hard work and resourcefulness demonstrate the resilience of the African female entrepreneur. Despite experiencing capital and cultural constraints women continue to pursue entrepreneurship as a path to financial freedom for themselves and their families and, in doing so, have found innovative ways to keep their businesses running. Through our numerous engagements with women across the continent at the Graca Machel Trust, we have witnessed the rise of African women who are not content running businesses for subsistence purposes only.”

Graça Machel, Founder, Graça Machel Trust

Our intention is to apply a gender lens investing approach to Africa. Gender lens investing is the use of finance as a tool for social and economic change. It incorporates gender analysis within the financial analysis process and is about how gender informs how and what we value, how we balance power dynamics and therefore how we invest. It is therefore not only about women entrepreneurs but the business ecosystem as a whole.

When we break down the aspects of an enterprise we see many ways we can create more gendered outcomes to better understand investment opportunities and constraints:

- Reviewing the product/service offering, customers, marketing approaches, sales and distribution strategies, the management team composition, supplier, service contractors and partner equity for gendered based outcomes.

- Challenging operational and human resource policies, financial and key performance indicators, as well as governance and ownership structures in organizations.

- Looking through a gender lens can reveal opportunities in a business such as how to capitalize on women being key influencers in consumer purchasing or which sectors attract or should encourage women.

- It can also reveal risks in a business like how a lack of diversity can lead to long-term blind spots and a lower rate of return. Investing in managing diversity is also key to ensuring tenure of diverse teams, successful implementation of solutions and improved corporate culture.

- Gendered fair pay and compensation across the value chain are all factors that can be addressed.

- Promote women’s leadership and influence in strengthening financial systems at national, regional, continental and global levels

- Provide innovative capital and support to women owned/led and focused enterprises to scale their businesses through debt, quasi equity and financially innovative solutions.

- Target companies that increase women’s business opportunities whether through supply and value chains or that increase female participation in governance and management structures and provides products and services that benefit and cater to women and girls.

- Engage in capacity building programs that strengthen the entrepreneur’s financial knowledge of different types of capital available for their business during varying stages to improve overall uptake and address any misconceptions.

- Mobilize female African investors to invest in this offering and thus increase their wealth and prosperity. Looking to allocate at least 10 to 20 % of fund in later stages to this pool of women.

- Have co–investor relationships with larger sized investment and impact aligned funds for follow on investment on deal sizes that exceed our deployment capacity.

- Region: An initial focus on East Africa ( Kenya, Tanzania and Uganda ) which will capitalize on Graca Machel Trust in country network presence and affiliation with women associations. We will also leverage on the graduates of our Women Creating Wealth platform which is in Malawi, Tanzania and Zambia.

- Two tier blended finance model with technical assistance program ( which provides investor readiness, shared service support with mentors, makes grants and issues short term debt ) through existing structures and forming a special purpose investment vehicle ( to deploy longer term debt and equity structures ).

- Fundraising goal: $30 million dollars for investment deployment which includes $ 3 million dollars post investment support services and $15 million for technical assistance pre investment fund. Post investment technical assistance will promote value creation in portfolio companies and will be structured as non-interest bearing loans or a 50:50 sharing split with the investee company to ensure alignment of goals.

- Financing structures: To be disbursed in a variety of ways and range from impact and performance based loans to profit sharing, convertible debt and equity on a case by case basis etc. Preference will be given to self-liquidating structures that suit the business profile.

- Deal size: Technical assistance facility would look at smaller deal sizes from $ 20,000 to $ 200,000 whereas investment fund would look at deal sizes from $ 200,000 to $ 2 million. Maximum investment is capped at $1 million per investee company. Average deal sweet spot is $500,000.

- Fund term: 10 year investment period with an option of extension for 2 years.

- Execution: Working within Graca Machel Trust and chosen technical assistance providers to offer non financial programs. In the special purpose vehicle, have a segregated team to co- manage alongside aligned impact fund managers to disburse capital using debt and equity structures.

We see gender lens investing accelerating financial sector deepening, promoting economic growth and leading to favourable gender equality outcomes. The aim of gender lens investing is to make the contribution and processes of gender ‘more visible’ and ‘less niche’.

This will require the formation of a bespoke investment vehicle whose aim is to provide initial capital to businesses that can allow follow on investment by either institutional or strategic investors. Furthermore partners can generate sustainable investment income for their programs whilst showing alignment to the UN Sustainable Development Goal number five, which is to “achieve gender equality and empower all women and girls.”

Leadership Team

Andia Chakava: Investment Director, Graca Machel Trust: Has over 15 years’ experience in fund management. She has been instrumental in the setup of two fund management companies in Kenya (Old Mutual Investment Services and Alpha Africa Asset Managers) where she served in each as Managing Director. She is also the co-author of a 2017 research published by the Graca Machel Trust called ‘Growth Barriers Affecting Female Entrepreneurs in East Africa’ and is currently leading the conceptual team to create a gender lens investment vehicle for Africa. She brings great expertise in pioneering investment products in new markets, business unit management, investment strategy formulation and implementation, deal sourcing, capital raising, product development, strategic partnership negotiations, project management and investor relations. She was the youngest female Managing director of a non-family business in Kenya in 2008 at age 30 and one of the first female fund managers in the region. In 2014 she was nominated most influential woman in Africa financial services category by CEO magazine and in 2018 was awarded Diversity and Inclusion Business Executive Champion in Kenya.

AndiaC@gracamacheltrust.org

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

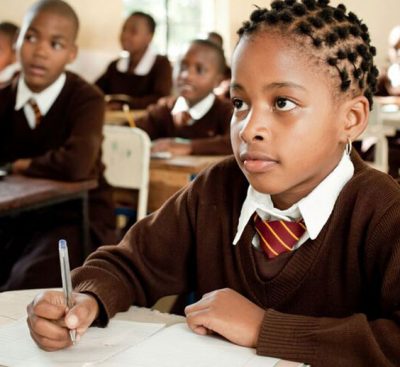

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.