AFRISHELA INVESTMENT FUND

Afrishela is the Trust’s incubated Investment Fund that is driving innovative blended capital to early growth stage women-owned and led businesses. Afrishela (her money) is a $30M gender lens investment vehicle designed, led and managed by African women whose theory of change is pegged on putting innovative and bespoke mezzanine investment capital into African women businesses along with tailored and gender and climate-forward technical assistance, and advocacy in favour of gender lens investing, to create a positive impact for women in the form of job creation, increased leadership and greater income equality. Ultimately this will lead to improved economic and social well-being in African communities with a disproportionate impact on women and girls and contribute to greater mainstreaming of gender lens investing in Africa.

Introduction

As a flagship initiative, GMT is creating an innovative financing Pan African gender lens investment vehicle to facilitate the flow of capital to women-led enterprises to meaningfully improve their quality of life, increase business size and revenue, influence household incomes, boost economic and job growth in African countries. It is an initiative that is designed by African women for African women.

FUNDING CHALLENGES FACED BY WOMEN ENTREPRENEURS

Access to capital continues to be the number one barrier faced by African Women Small and Medium Businesses (The World Bank, 2013) with the gender financing gap as measured by the 2017 IFC MSME Finance Report standing at $42 billion for Small Medium Enterprises in sub-Saharan Africa (SSA). Many women businesses are caught in the ‘missing middle’ and “often classified as too big or unsuitable for microfinance, too risky for banks and too small for private equity” therefore left out of financing opportunities.

“According to IFC’s 2019 Gender Diversity Study female deal partners invest in almost twice as many female-led businesses as male deal partners, and fund managers with diverse leadership teams, including female partners, tend to have more diversified portfolios of investees.”

FRISHELA SOLUTIONS

OUR INVESTMENT APPROACH

We employ the use of blended finance by providing post investment technical assistance alongside investment capital, applying a gender lens in the investment process, employing a milestone-based approach to investing.

We target women-owned and led businesses with representation of women within leadership, the workforce and value chains, and with products and services that impact the under- served female segment. We seek to actively surface and support women in climate with innovative and sustainable solutions that can be strengthened and scaled to support climate adaptation and contribute to uplifting women’s incomes and community’s participation in climate action.

We provide innovative, responsive financing through mezza- nine structures such as impact linked loans and revenue based finance for 75% of our portfolio. We target countries where women entrepreneurship is dominant and growth opportunities exist for women businesses. Our initial countries of focus are Kenya, Uganda, Tanzania, Rwanda in East Africa and South Africa and Zambia in Southern Africa. We prioritise sectors where women are prevalent to increase their power and influence whilst boosting their participation and role in male dominated sectors. Our priority sectors include Agricultural value chain, Manufacturing, Renewable Energy, Retail, Health, Education and Financial Services. Our deal sizes range from $20K – $500K with an average of $300K for mezzanine and $400K for equity structures. Our expected gross IRR is 14% with a net IRR of 8%. Impact is at the heart of our investment strategy and we are deliberate to promote impact across gender and climate as well as youth, informal sector and low income communities through products and services, as well as across value chains.

OUR SCALING AMBITIONS

We shall apply a learning and scaling model to our expansion as we leverage Afrishela fund I to catalyse our impact fund (our broader vision of a $200 Million dollar fund with approximately $50 million per region to align with our Pan African mandate) by increasing our track record in gender lens investing, demonstrating proof of concept and catalysing additional investment for follow on funding for our pipeline upon exit.

Join us as we invest in innovative early growth stage women owned and led businesses that are working on gender smart and climate adaptive solutions that improve the lives of women and support the environment.

Supported by:

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

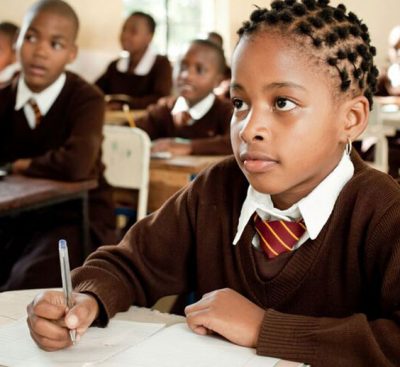

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.