Women are significant contributors and drivers of economic growth through entrepreneurship and their involvement in the labour market. Although women-owned businesses have increased over the years, women continue to encounter many obstacles in sustaining their businesses, especially access to finance. Women require a level playing field in the banking and financial sector that will enable women to access affordable financial services to maximise their economic opportunities. According to the 2020 Finscope Topline findings, Zambia has a population of 17.9 million. Of this, men’s financial inclusion is at 71.2%, whilst women’s is at 67.9%, with women being the most disadvantaged.

The Founder of the Graça Machel Trust, Mrs Graça Machel, accompanied by her Special Advisor Leila Akahloun and the Trust’s Director of Programs Shiphra Chisha, travelled to Lusaka, Zambia, from the 15 to 18 August 2022. During the visit, Mrs Machel had an opportunity to hold meetings with the Trust’s-initiated Networks and the Expert Leaders Group (ELG) members. Besides visiting women-owned businesses to see the progress made through different initiatives, Mrs Machel held a session with the Expert Leaders Group (ELG) and Zambia Financial Service Sector leaders. It aimed to drive the ELG agenda through the Attainment of Commitment from the Financial Services Sector Leaders to Achieve a 40% Women Leadership Representation in Economic Task Forces and selected Institutions.

Network leads in Zambia

During the last day of their visit, the team’s agenda was to meet with the Women’s Leadership for Financial Inclusion and Economic Recovery and members of the Zambia financial services sector. It was geared toward amplifying and strengthening women’s economic leadership in accelerating financial inclusion in Zambia and securing commitment to adopting women-centred financial inclusion and economic recovery. The three-hour sensitisation workshop was hosted by the Bankers Association of Zambia; anchored by the ELG Member, Dr Tukiya Kankasa-Mabula, and participation by Mrs Graça Machel, Zambian Commercial Banks, representation from ABSA- Zambia, Stanbic Bank, Anakazi Initiative, Lusaka Stock Exchange and the Trust’s Women’s Network Country Chapter Leads.

Dr Tukiya Kankasa-Mabula ELG member and Mrs Graça Machel

Dr Tukiya Kankasa-Mabula emphasised the need to strengthen women’s leadership because their efforts would lead to transformative policies related to women’s financial inclusion in Zambia. The Managing Director of Absa-Zambia, who is also chairperson of the Bankers Association of Zambia, Ms Mizinga Melu, addressed critical issues on the state of women’s representation in financial institutions in the country. She said that remarkable progress had been made in bridging the gap and upscaling women’s leadership roles in the economy. However, the banking sector continues to ponder ways to enhance financial inclusion for all and promote women’s leadership in decision-making, especially within the financial sector.

Managing Director of Absa Zambia, Bankers Association of Zambia Chairperson Mizinga Melu with Mrs Machel during the convening

Other discussions focused on deliberate initiatives being made toward women’s financial inclusion. These include products such as the Anakazi Initiative, which facilitates women’s economic and social empowerment by developing business development support networks, increasing knowledge of global issues, advocating for human rights, and supporting the equal participation of women and men in addressing development issues. The Ellevate programme is also a women-focused initiative that Ecobank has designed for women-owned businesses, managed by women, businesses with a high percentage of female board members or employees, and companies manufacturing products for women. However, it was noted that the number of women reached was still low and needed to be upscaled.

The Trust’s Director of Programs, Ms Shiphra Chisha, reiterated Dr Tukiya’s and Ms Melu’s statements, urging the women to “Throw away the box. Work out of the box and redesign the table not alone, climb not alone, but with other women.”

“It is becoming a reality that women are taking their leadership and strategic positions in many sectors,” said Mrs Machel during her keynote address. She then spoke on the importance of collectively working towards increasing the rates and numbers of women’s leadership representation within the financial services sector. She argued that there is a need to know the numbers by sector; know the barriers; explore appropriate science to obtain, interpret and leverage the received data, and position ourselves to change the landscape. This is the only way to truly realise women’s financial inclusion and facilitate access to finance as a collective.

Speakers at the event addressed the participants on the importance of financial inclusion

Zambia National Commercial Bank (ZANACO) board member Mrs Chearyp Sokoni thanked the Trust’s leadership, especially Mrs Machel’s passion for the initiatives that continue to drive the advocacy agenda in promoting opportunities to advance the growth of women’s businesses. One critical area around leveraging the digital economy to encourage entrepreneurship. What was also most important was the realisation that Zambia and the continent at large can only develop if women in decision-making positions pull other women up to actualise their full potential, she added.

“Let’s pull women into financial inclusion; increased viable investments; digital inclusion; access to information and networking. More can and should be done for the greater good of women at all levels, and [we all] have a pivotal role to play in this agenda. You are the solution, so take the challenge,” – Chearyp Sokoni

Mrs Machel also held meetings with development partners to discuss, among other matters, their commitments to the regional agenda. The partners engaged were The United Nations Economic Commission for Africa (UNECA) alongside UNICEF, UNDP, UN Women, UNFPA, COMESA, the Common Market for Eastern and Southern Africa, and USAID, focusing on women in trade.

Development partners were critical during the visit.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

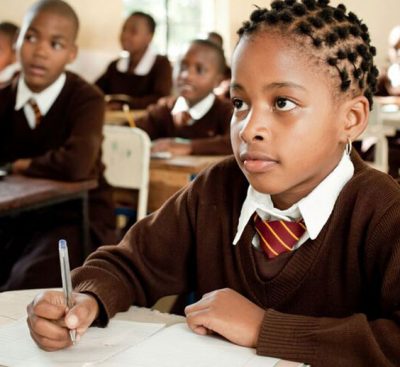

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.