Africa continues to be positioned as one of the fastest-growing leaders in financial inclusion initiatives, with several markets at the forefront of establishing cases for the adoption of digital finance to promote access to much-needed services like health, education, and agriculture. In Mozambique, financial inclusion has been identified to provide an opportunity for digital services, particularly as policy and regulation in the country continue to evolve and seek to promote fintech innovation and development.

The Seventh Annual Mondato Summit Africa is the region’s premier digital finance thought leadership event, showcasing financial technology across sectors. It also provides an opportunity for different sectors to address the opportunities for innovation and collaboration needed to drive the next wave of digital services to respond to the changing needs of a pandemic-altered Africa.

Chair Expert Leader Group in Financial Inclusion and CEO of FSD Zambia, Engwase Mwale and Kajsa Johannson, Head of Corporation, SIDA.

This year, the summit pulled together executives, entrepreneurs, experts and public sector leaders in Maputo, Mozambique, on May 17 and 18 under the theme “Beyond Access: Generating Value through Digital Inclusion & Transformation in a Pandemic-Altered Africa“. The theme speaks to the ongoing global discussions of equity and inclusion and proves a particularly pertinent topic that has guided our transition to a “new normal.”

The Graca Machel Trusts’ New Faces New Voices (NFNV) Women in Finance Mozambique Chapter was selected to partner with Financial Sector Deepening Mozambique and Instituto Nacional das Comunicações de Moçambique (INCM) to host the market during the event. Mondato selected Mozambique as the host market for this year’s event, considering the rapidly growing opportunities for digital services targeting the country’s low financial inclusion, which follows the evolution of Mozambican policy and regulation seeking to promote fintech innovation and development. The two-day conference created the space to discuss these trends and opportunities in the context of Africa’s COVID-19 recovery.

Bridging the Gender Gap: A Focus on Transformation Opportunities on Innovation and Entrepreneurship

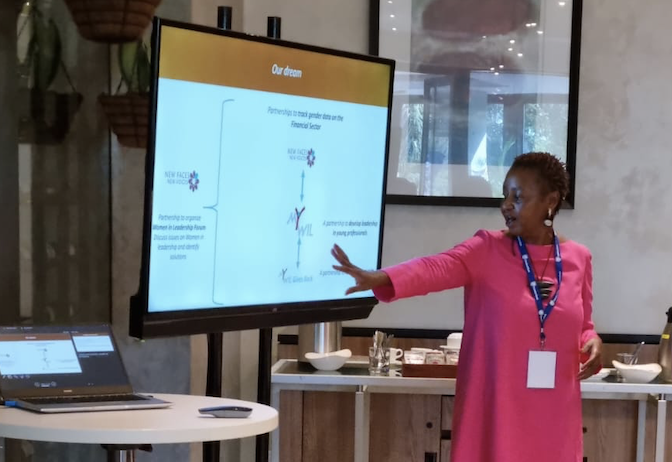

During the summit, the NFNV Mozambique chapter hosted a side event attended by 50 Women Leaders across the financial sector ecosystem, themed “Female Leadership Across the Financial Sector in Mozambique.” The main objective of this convening was to grow the number and visibility of African women in leadership and decision-making in the financial sector. NFNV Mozambique Country Director Ms. Henriqueta Huaguana provided a context of Mozambique based on the representation of women in the Boards of Directors and Commercials Bank. She said, “Across thirteen institutions of which an undisclosed institution had 43% women in a decision-making role in the country versus two unknown institutions reporting 0% women representation at a senior level; compared to former years where they were 4 financial institutions without women representation.”

NFNV Mozambique Country Director – Henriqueta Huaguana, key panelist on Promoting Female Leadership in Financial Sector in Mozambique.

Tambu Ndoro, Programme Manager of the Women’s Economic and Social Advancement Programme at the Trust, moderated the session. In a popcorn-style discussion posing a question on what action as women we can implement to change the current landscape, participants’ discussion included early-stage innovative approaches to grow and nurture the role of women in finance across Africa. These possibilities range from local language radio dramatisations aimed at teaching rural women financial literacy to mentorship programs that foster confidence in young professional women in banking innovations.

“Innovation must strive to reach women and girls wherever they are. It is not enough to appoint women to the top corridors of power in financial institutions. Women should not only represent but must also be impactful in their role in accelerating and bringing more women up into C-Suite roles.”

Tambu Ndoro- GMT WESA Programme Manager moderated the Women’s Breakfast attended by 50 women leaders from various sectors, hosted by NFNV Mozambique.

A Call to Bold Action

Gender Policy, Bank recruitment policy & understanding the barriers that women in finance face and gendered impacts of workplace promotions, and be informed by the Voices of Women

Women and women’s organisations should be at the heart of promoting female leadership in the financial sector and across decision-making bodies by designing mentorship and peer-to-peer learning programs that continue to support women professionals. A system for collecting and qualitative data needs to be implemented to ensure it informs the redesign of mentorship & leadership programs to increase women’s capacity to lead. In addition, integrate gender policy within HR policies to prioritise mentoring and provide training in gender analysis to foster intentionality of gender-inclusive practices.

Sensitisation and early intervention in Financial Education

An intentional focus on the lives and futures of women and girls is an essential part of breaking structural practices in the workplace which have been marginalising them. Financial education must start earlier at a family and community level; start with the girls and build their confidence and capacity to take the course.

Develop and establish innovative solutions that are gender transformative to ensure rural women gain access and usage to financial services and products

Remove structural barriers to access finance by improving existing Know Your Customer (KYC) requirements and support enabling environment private sector so rural and urban women can participate and contribute impactfully to the digital economy and financial inclusion. The session concluded with Henriqueta sharing the MYWIL program (Mozambique, Young Women in Leadership) run by NFNV.

To learn more about the interventions, participants are invited to email her at hhunguana@icc.co.mz

For further engagement

The Trust, alongside the FSD Network and FinEquity convened by CGAP is working on launching a community of practice focused on women’s financial inclusion in Africa. This community of practice aims to deepen connections, collaborations, and action on advancing women’s financial inclusion and economic empowerment in the region. The community will be launched in August 2022. If you would like to be the first to know more about what we have planned and how to engage, please fill out this short interest form: https://www.surveymonkey.com/r/FQKJ3PN

Written by: Tambudzai Ndoro, WESA Program Manager

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.