Opportunities exist to deepen and accelerate financial inclusion through digital finance as a lever for contributing to economic recovery and growth. On 25th August 2021, the GMT Expert Leaders Group (ELG) and the Network leads held a joint meeting to highlight the 3-year work plan and regional analysis of COVID-19 Women’s Financial Inclusion in the Digital Economy. This high-level Expert Group of African Women Leaders in the finance sector is a GMT-led group of strong actors to drive systemic action to advance women’s active participation in the digital economy.

Expert Leaders Group Convening.

The convening began with opening remarks from ELG leader Dr Tukiya Kankasa-Mabula. She explained that having all stakeholders present was a way to move global interventions to local. The session was more about peer learning than peer learning rubberstamping the ELG plan. Dr Tukiya’s introductory message was followed by the Expert Leaders Group on Women’s Financial Inclusion 3-year work plan presented by GMT’s Director of Programmes, Dr Shungu Gwarinda.

“The goal of the ELG is to influence transformative policy actions that promote opportunities to advance the growth of women’s businesses as a pillar of economic recovery and reconstruction from the impact of the COVID-19 pandemic in Africa, ” echoed Dr. Shungu Gwarinda.

The agenda of the ELG is to push for bold actions to advance:

- Women’s financial inclusion;

- Leveraging of the digital economy to promote women’s entrepreneurship;

- Unlocking of resources for increased investment in women’s businesses for growth.

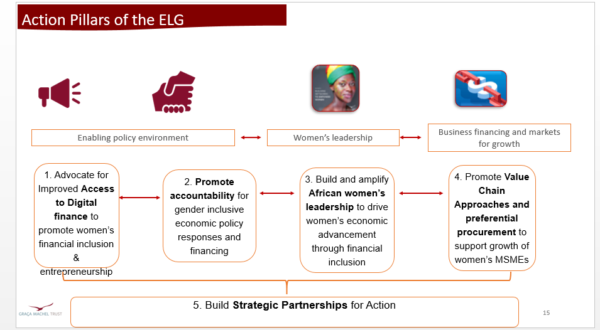

Action pillars of the ELG

Participants also weighed in on ELG’s three-year plan. Among the suggestions shared were the need to have and use Gender-disaggregated data to assess the situation and develop appropriate, evidence-based responses and policies. In addition, the need to explore an insurance perspective as most times focus on access to finance and insurance isn’t part of the conversation, and the deterrent is unawareness and education. There was also the subject of using mobile money for building a credit/transactional history that can be used with collateral to get financing.

Some of the participants during the Expert Leaders Group Convening.

The meeting ended with a presentation of the Women’s Financial Inclusion in the Digital Economy: Regional Analysis of COVID-19 Economic Responses Study. It had several key insights including:

- In developing economies where the vast majority of women’s employment – 70 % – is in the informal economy, COVID-19 regulations mainly affected them. Some of them had to Downsize and lay off staff.

- There was an increase in child marriages, teenage pregnancies and gender-based violence.

- Control measures such as transport restrictions, quarantine, social distancing, and bans on weekly markets also affected businesses.

- Virtual marketplaces have become the norm for both businesses and consumers.

- The study revealed that about half of the participants had digitalised their products and services before COVID-19.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.