Did you know that over 70% of informal cross-border traders in West Africa are women, yet many lack access to the digital tools needed to grow and scale their businesses? To address this pressing challenge, the Graça Machel Trust, in collaboration with Network for Women’s Rights in Ghana (NETRIGHT), New Faces New Voices Nigeria, and ComDev Senegal, recently hosted an ECOWAS Expert Leaders Group in Financial Inclusion convening in Accra, Ghana. Themed “Digital Transformation and Cross-Border Trade: Unlocking the Potential for Women Entrepreneurs in West Africa,” the ECOWAS Convening brought together over 200 participants, including women entrepreneurs, policymakers, and industry leaders, to explore innovative solutions to support women in cross-border trade through digital technology and financial inclusion.

In her opening remarks, Patricia Akakpo, Executive Director of NETRIGHT, highlighted the transformative potential of digital technology for women entrepreneurs in West Africa, underscoring how tools like mobile payment platforms and e-commerce are reshaping business operations, offering opportunities to expand markets, reduce costs, and scale businesses. However, she stressed that the digital gender divide continues to exclude many women, calling for targeted policies, infrastructure investments, and digital skills training to bridge this gap. “Women are the backbone of our economies, yet systemic barriers limit their potential,” she stated, urging collaboration between governments and private stakeholders.

Ms Shiphra Chisha, Director of Programmes at GMT, reiterated the Trust’s dedication to amplifying women’s voices and advancing financial inclusion. She applauded initiatives like the Bank of Ghana’s financial literacy campaigns targeting underserved areas and establishing the Women in Finance Association. Promoting women’s financial inclusion is not just an agenda—it’s a transformative goal requiring sustainable partnerships and systemic change,” Ms Shiphra said.

Deputy Governor Elsie Addo Awadzi of the Bank of Ghana highlighted the important role of policy in enhancing women’s access to digital financial services. She noted how mobile money has revolutionised financial inclusion, yet challenges such as limited smartphone access and fraud in digital transactions persist. “Many women lack access to smartphones or digital literacy to navigate these tools. Fraud in digital transactions further discourages adoption.” She added that “policies must address these obstacles to ensure women are not left behind in the digital revolution.

Since 2021, the Trust has partnered with FinEquity Global (convened by CGAP) and the FSD Network, a regional community of practice dedicated to advancing women’s financial inclusion and ensuring equitable access to financial services across Africa. Tariro Nyimo, Regional Facilitator for FinEquity Africa, highlighted how FinEquity collaborates with like-minded partners to help close the gender gap in digital financial services for women.

The highlight of the convening was the keynote address by Mrs. Graça Machel, Founder of the Trust. She called on all stakeholders to unite to break down socio-cultural and technological barriers that limit women entrepreneurs. Mrs Machel emphasised that advancing women’s participation in the digital economy is not just an issue of fairness but a driver of transformative economic growth. “Let us work together to influence gender-sensitive policies, champion financial inclusion laws, and educate others on the power of digital tools for women,” she urged, delivering a powerful call to action. She concluded with a compelling message: “When we support women, we uplift families, strengthen communities, and build nations. Together, we can create a future where women entrepreneurs drive innovation and shared prosperity for all.”

Addressing systemic challenges

Systemic challenges, including limited digital literacy, high technology costs, and restrictive trade policies, took center stage at the convening. Speakers emphasised the need for practical solutions to these barriers, highlighting their collective impact on women’s ability to engage in cross-border trade and the digital economy. Addressing these issues, they agreed, is key to creating opportunities for women entrepreneurs and driving inclusive growth.

Dr. Loretta Sarpong, Retail Banking Specialist at Ecobank Ghana, highlighted how digital tools can transform trade for women entrepreneurs in West Africa. She shared success stories and stressed the importance of improving digital literacy and ensuring affordable access to technology.

Dr. Tukiya Kankasa-Mabula, Interim Chairperson of the Expert Leaders Group, underscored the urgent need to close the gender gap in digital access, calling it both a moral and economic necessity. She urged stakeholders to develop affordable tools, inclusive policies, and streamlined trade frameworks to support women. “Each of us has a role to play,” she said, calling for collective action to foster innovation and support women-led businesses.

Panel discussions examined the potential of the African Continental Free Trade Area (AfCFTA) to benefit women entrepreneurs. While progress is being made, barriers such as limited digital literacy, high internet costs, and regulatory challenges persist.

The convening concluded with strategies to bridge the digital divide, enhance cross-border trade, and establish supportive policies. These efforts are setting the stage for inclusive growth, but sustained collaboration will be crucial to ensuring women entrepreneurs can thrive in the digital economy.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

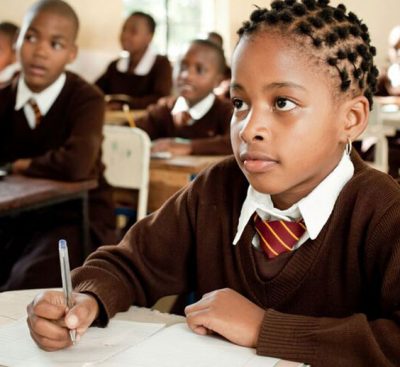

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.