The Graça Machel Trust (GMT) convened the Southern African Development Community (SADC) Regional Convening to discuss the importance of digital finance in promoting women’s financial inclusion.

The event, held virtually on September 14, 2023, under the theme Digital Finance: A Panacea for Women’s Financial Inclusion, brought together thought leaders, experts, policymakers, and practitioners from across the region. This included over 100 participants, women entrepreneurs spanning various business sectors, financial institutions, regulators, regional economic communities, development sector partners, private sector stakeholders and academia.

Access to financial services is critical in empowering women and promoting gender equality. However, women in many parts of the SADC region face significant barriers when accessing formal financial services. Limited access to banking infrastructure, lack of identification documents, and cultural norms restricting women’s financial autonomy all contribute to this challenge. Digital finance has emerged as a powerful tool to address these barriers and enable women to participate fully in the economy. By leveraging mobile technology and digital platforms, women can access various financial services such as savings accounts, micro business loans, insurance, and payment systems – depending on the country they’re in.

The convening provided the speakers with the platform to discuss various initiatives, challenges and success stories from across the region that have leveraged digital finance to promote women’s financial inclusion. They explored strategies to expand the reach of digital financial services, improve financial literacy among women, and address the unique challenges rural and marginalised communities face.

How Women are Shaping the Future of Financial Inclusion

HE Graça Machel, founder of the GMT, emphasised the importance of digital finance in achieving financial inclusion for women. She said, “The GMT convening on Women’s Financial Inclusion in the Digital Economy is both timely and critical. In a world increasingly driven by technology and innovation, we must ensure that women in rural or urban areas have equal access to the tools and resources that will consistently enable them to thrive and be atop their businesses. With its vast opportunities for financial inclusion, entrepreneurship, and education, the digital economy should be a realm where women are both participants and leaders.”

“Women dominate the continent’s most important sectors, and when they lack access to financial services, their ability to invest in modern technologies to raise their productivity is limited. This means that if a woman is in agriculture and lacks access to finance, she cannot grow high-value crops, invest in assets, diversify her business, and cannot invest in better nutrition for her children, as well as those she serves – how concerning and disturbing this is, for us all.” Said GMT’s Director of Programs, Shiphra Chisha, echoing Mrs Machel’s sentiments.

“In sub-Saharan Africa, only 37% of women have bank accounts, lagging behind the 48% of men. The North African region paints a starker picture with a whopping 18% gender gap – the world’s highest, leaving two-thirds of adults unbanked.”

Dr Charity Dhliwayo, Deputy Governor of the Reserve Bank of Zimbabwe, emphasised the critical role of women entrepreneurs in Africa’s economic growth and that the financial sector is the backbone of women entrepreneurs’ success. Designing gender-sensitive financial products and actively promoting women leaders in finance are key to bridging the $42 billion financing gap for women entrepreneurs in Africa. She said, “As a collective, we aim to draw on the outcomes from this event to shape our path toward realising the change and impact we envision for women’s financial inclusion in the SADC region.”

Dr Amany Asfour, President of the Africa Business Council, has emerged as a leading voice driving financial inclusion for women across Africa. She shed more light on her Council’s Advocacy Policy and its pivotal role in shaping the future of financial inclusion and how she is spearheading numerous initiatives to empower women economically and ensure their active participation in the financial sector through strategic collaborations with key stakeholders. She said, “Governments, financial institutions, technology providers, civil society, and organisations must collaborate. Together, we can ensure women have equal opportunities to thrive in the digital financial ecosystem, fostering an inclusive and sustainable development journey across our continent.”

Key takeaways from industry experts

Recommendations of GMT NFNV Network’s SADC Policy Brief 2022 and Zimbabwe Gender Norms, Financial Inclusion Policy Brief 2023

Women are increasingly driving the future of financial inclusion, and industry experts have insights to share on how best to harness this potential. Gender Norms, Financial Inclusion Policy Brief 2023 provided detailed recommendations on better understanding and closing the gender gap in financial inclusion in the SADC region. Gladys Kanyongo of New Faces New Voices Zimbabwe network shared policy recommendations from a policy brief which underscored gathering gender-disaggregated data, implementing national financial inclusion strategies, creating supportive legal frameworks, and establishing regulatory sandboxes for innovation.

Understanding the Gender Gap in Financial Inclusion in SADC

Blessing Mautsa from Finmark Trust spoke on the efforts to promote women’s financial inclusion in the region. He said, as part of the regional drive to promote women’s economic empowerment and gender-responsive development, SADC has established the Regional Multi-Dimensional Women Economic Empowerment Programme 2020-2030, which emphasises the need to support member states with innovative ideas, guidelines, and priorities for increasing women’s access to, and use of, productive resources, including access to finance.

Enabling Regulatory Environment in SADC

The banking sector plays a crucial role in advancing financial inclusion and the regulatory environment in the region. Happy Mulwe from the Bank of Zambia emphasised the need for regulatory bodies to ensure institutions are adaptable to technological advancements while maintaining financial stability. Policies related to digital currencies and virtual assets should be based on research and strike a balance between risk mitigation and innovation. Implementing SADC regulatory policies, frameworks, and payment discussions is critical for member states’ consensus.

In Zimbabwe, Simbarashe Mashonganyika from the Reserve Bank of Zimbabwe highlighted that a stable macroeconomic environment and regulatory framework are essential for developing digital financial services (DFS). Currency and exchange stability are crucial for the usage of DFS. Regulatory flexibility allows for innovation in products and channels. Harmonisation of regulations helps protect consumers and prevent exploitation. He said, “Women have unique banking and financial needs that should be considered. Consumer protection and financial literacy are important for building trust in DFS. Developing mobile and banking apps in local languages can help increase adoption in rural areas. Government and central banks should control rising tariffs and charges.”

Innovations in Digital Finance

Munyaradzi Nyakwawa, from Moneymart Finance in Zimbabwe, discussed the importance of digital finance innovations for sustainable development. He highlighted the challenges women face in digital finance and the benefits it can bring. Digital finance can enhance resource mobilization, remittances, planning, economic growth, and financial access for the poor. It can also reduce costs, improve data analysis risk management, and open new markets. Innovations in digital finance are crucial for an inclusive and sustainable economic future.

A showcase into the Graça Machel Trust’s Women’s Financial Inclusion and Empowerment Experience

The Graça Machel Trust’s decade-long commitment to advancing women’s financial inclusion is not just a mission. It is a transformative journey, done through engagements with global decision-makers, the creation of robust women-led networks in finance, and the fostering of collaborations between stakeholders. GMT has not only secured commitments but has also ignited a movement.

Investment Director of the Graça Machel Trust’s gender lens investment vehicle, Afrishela, Andia Chakava, concluded the event with an inspirational showcase of GMT Women’s Financial Inclusion and Empowerment Experience, reaffirming the importance of their work. With a focus on demand-led design and a co-creation approach, GMT is charting a path forged by African women for African women. This journey is poised to make significant contributions for women, such as using alternative credit assessment methods, creating innovative financial instruments for early growth stage businesses, providing technical assistance and networking opportunities, aligning investments with values such as gender equity and environmental sustainability, and prioritising impact by focusing on job creation and environmental outcomes.

“Globally, women are transforming the future of financial inclusion. GMT’s work is making a tangible, positive impact by deepening the field and providing valuable insights into what works and what is possible. By serving as a beacon of credibility, GMT is also helping to attract more capital flows to drive financial inclusion. With each innovative step, it is clear that women are shaping the future – and it’s exciting.”

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

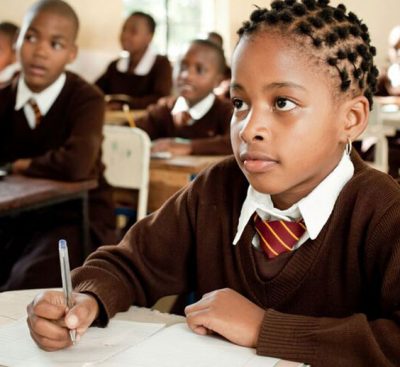

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.