Women’s financial inclusion should include a collective effort to ensure all women have adequate access to appropriate financial products. “Women are significant contributors and drivers of economic growth through entrepreneurship and their involvement in the labour market. The Graça Machel Trust’s Chief Executive Officer, Ms Melizsa Mugyenyi, underlined this point during the Southern Africa Regional convening on Women’s Financial Inclusion in the Digital Economy, which took place on 20th September 2022. The Trust’s Women Economic and Social Advancement (WESA) Programme organised the virtual event in collaboration with the Expert Leaders Group (ELG). The ELG is a high-level expert group of strong African women leaders in the finance sector convened by Mrs Graça Machel to drive systemic actions in advancing women’s active participation in the digital economy.

Part of the speakers during the online Convening themed The Determinants for Women’s Access to Finance for Women in Business

Theme “The determinants for women’s access to finance for women in business”. This aligns with the Trust’s mission and strategic objective advocacy efforts toward accelerating the economic advancement of African women. It is also a critical time for strengthening existing country-level businesswomen’s associations, building networks of women in sectors vital for Africa’s growth, increasing women’s access to finance and financial services, and strengthening women-owned/led businesses to grow.

In her opening remarks, Ms Mugyenyi said, “although women-owned businesses have increased over the years on our continent, we know that they continue to encounter a myriad of obstacles in sustaining their businesses, especially around access to finance.” She emphasised bold policy actions that need to be taken to promote deepened gender-lens investments in women-owned businesses. Ms Mugyenyi also stated the need for strategic partnerships to expand equality of opportunity for women and inclusive recovery and reconstruction programs that counter the adverse impacts of effects out of our control, including COVID-19. Further, she mentioned the Trust, alongside Financial Sector Deepening programmes – FSD Network and FinEquity convened by CGAP, launched a community of practice focused on women’s financial inclusion in Africa. This aims to accelerate women’s economic empowerment through financial inclusion. “The Graca Machel Trust will support this regional group to place higher demands on the financial inclusion ecosystem while providing shared expertise and passion for driving the women’s financial inclusion advocacy agenda.”

In her keynote address, Ms Gail Makenete, the Convenor of the Expert Leaders Group (ELG), called on participants to consider concrete steps to move local implementing networks into distinct action programs. She encouraged women across the continent to make sufficient noise to policymakers to be heard and propel their initiatives to grow from micro to medium and large-scale enterprises to create employment and generate income for themselves. She maintained that these businesses will begin to develop our economies. She also asked the Expert Leaders Group to influence policies in their respective jurisdictions and advance the cause of women-specific national financial policies.

Mr Peter Varndell, Executive Secretary of SADC Business Council, shared some updates on what the SADC Business council has done to support women entrepreneurs to get more access to finance, as women in business are seen as a crucial priority to them. In his remarks, he highlighted that lack of financial education is one of the foremost limiting factors. Women entrepreneurs face grave challenges in accessing funding and financial services in most developing countries, with lack of financial education being one of the main limiting factors. He pointed out that the SADC Business Council is working closely with development banks and institutions to prioritise developmental agendas that are more inclusive. There is a need to use a gendered lens when designing banking and finance policies, given that crises disproportionately impact women. Therefore, the existing landing mechanisms must be geared towards preferential considerations for women”, he said. He added that strong collaborations with the SADC Business Council would be needed to support the different initiatives highlighted in the convening discussions.

Dr Charity Dhliwayo, Former Deputy Governor of The Reserve Bank of Zimbabwe and the ELG representative of Zimbabwe, gave a keynote presentation and spoke on how leaders can contribute to the success of women-led-enterprises through financial inclusion, noting the significant role women entrepreneurs play in national development and social progression through job creating, poverty reduction, human development, education, health particularly in developing countries. According to Dhliwayo, studies show women represent 40% of the world’s workforce and many critical sectors for economic growth – some of the poorest countries rely heavily on women. the World Bank estimates that 58% of all African small and medium enterprises SMEs are women-owned and yet they are deemed 34% less profitable than men-owned enterprises. She added that women entrepreneurs face myriad challenges that include the work-life balance due to socio-cultural responsibilities, lack of education which impacts financial literacy, inadequate support systems and limited access to finance.

“There is evidence from studies that if the financial services industry does nothing but just include women at the same rate as men, they would unlock more than $700 billion in revenue yearly from deposits, insurance, premiums and loans and other services. To unlock this growth, women-led- businesses should have access to financial products and services that suits their unique financial needs,” said Dr Dhliwayo.

This regional convening also provided an excellent opportunity for women to speak beyond their expected domestic circles. The panel discussions and highly interactive sessions engaged panellists who shared perspectives, successes, and challenges faced by women on topics around research and gender-disaggregated data on women’s financial inclusion, capacity-building services for women entrepreneurs and access to funding.

Key takeaways from the panellists

The Trust’s WESA Programme Officer, Neo Mofokeng, moderated the event. Panellists included Jane Muia, the Trust’s Investment Analyst, Gladys Kanyongo, Project Coordinator of New Faces New Voices Zimbabwe, and Dalree de Lange, the Trust’s Women Creating Wealth (WCW) Project Coordinator. Leading experts from the financial sectors joined them;

- Damola Owolade, the Head of the SADC Financial Inclusion Programme at the FinMark Trust

- Mothetsi Sekoati, Director of Payments and Settlements, Central Bank of Lesotho

- Dr Lucia Mandengenda, Chairperson of New Faces New Voices Zimbabwe

- Henriqueta Huaguana, Director, New Faces New Voices Mozambique

- Korkor Cudjoe, Women Creating Wealth Project Lead for the Graça Machel Trust

Mr Owolade shared insights on work done by Finmark Trust to mediate gender biases that limit access to productive resources such as access to finance in the SADC region. He highlighted cross-border trade, which is highly dominated by women, giving the example of Zimbabwe’s informal cross-border trade association, whose membership is over 70% women. He echoed SADC Business Council’s point on African Free Trade Agreement as an important motivation to think about how to support cross-border traders in the region. “We know there isn’t any bespoke payment solution for micro traders in the region, so micro traders only have options to use telegraphic transfer or bank-related services to make cross-border trade payments.”

Mr Sekoati shared insights and financial data from Lesotho. He said, “Lesotho is one of the few countries with positive financial inclusion female gender-gap uptake mainly driven by mobile money and funeral cover uptake.”

Dr Mandengenda gave a context of Digital Financial Inclusion in Africa and how this can improve women’s MSMEs. She emphasised the need for strengthening access to mobile money accounts, identifying systems and documents for women and ownership of mobile phones, and supporting National Financial Inclusion Strategies to address women’s and men’s needs. “Reform barriers embedded in laws, regulations, and institutional norms and promote women’s economic and financial participation and Financial Inclusion reporting sex-disaggregated data and use data to design women-friendly products and marketing”.

Ms Huaguana spoke about capacity building and training necessary to build SMEs’ capacity. She underscored the importance of access to information as women are enthusiastic about receiving training and tend to seek much more information before making important decisions but struggle to access the right information to inform their decisions.

Still, on capacity building, Ms Cudjoe pinpointed the Trusts’ an initiative with the African Development Bank (AfDB) dedicated to focusing on how we become very intentional in developing capacity-building initiatives that allow more women to get financed. “In our case, we are looking at 20% of our 450 entrepreneurs to be able to get finance at the end of two years…We also talk about the high failure rate of entrepreneurs, but I think successful entrepreneurs have many lessons from failing in different aspects of their businesses. So they need to get to the level where they use those lessons to accelerate growth in their businesses. So we want to best build, you know, failure as part of the entrepreneurial process so that when failure comes, entrepreneurs are not discouraged but build resilience.”

Aude de Montesquoi, FinEquity’s Facilitator, shared more about the Global Community of Practice which is focused on helping accelerate women’s economic empowerment through financial inclusion and its partnership with the Trust, the financial sector deepening network. Driven by membership, the goal of the regional hub will enable the facilitation of a regional community of practice on the access and use of a wide range of financial services across the African continent. “We try to help knowledge generation of the best practices and encourage sector collaboration.” Montesquoi has invited those interested in joining and participating to sign up for FinEquity Africa. “The regional chapter is dedicated to promoting women’s economic empowerment through financial inclusion in Africa. “The partnership with the Graça Machel Trust and the financial sector deepening network will be able to address various issues, including social norms, digitisation of financial services for women’s pathways to impact. We hope there will be a thriving dialogue in Africa at the local, regional level.”

The virtual meeting was attended by over a hundred participants from the Trust’s partner institutions in civil society and NGOs, Women Entrepreneurs across business sectors, financial institutions and regulators, regional economic communities, development sector partners, private sector stakeholders, and members of academia and media, who joined to share and discuss the extent to which women-led MSMEs are less able to access finance, to identify possible digital solutions for women’s financial inclusion and advocate for increased inclusivity of women’s financial inclusion in the digital economy.

For over a decade, the Trust has advocated for women’s financial inclusion on the continent. The Trust’s initiatives have amplified women’s movement building to engage the financial inclusion ecosystem, seeking ways in which women can access finance and markets for their businesses. In addition, by engaging in policy dialogues through our country chapter networks, the Trust has contributed to a gender-inclusive financial sector that places women at the core of change and enables equitable access to finance.

About the Graca Machel Trust Expert Leaders Group (ELG)

The Expert Leaders Group (ELG) is a high-level expert group of strong African women leaders in the finance sector that are driving systemic actions to advance women’s active participation in the digital economy. The Graca Machel Trust convened the ELG under the leadership of Mrs Graça Machel, consisting of female Deputy Governors of Central Banks, financial regulators and senior financial sector leaders to elevate the voices of African women. These priorities help build inclusive economies and institutions that respond to the needs of women. The ELG represents the five African regions and collaborates with the Trusts’ Women’s sector-based Networks to build stronger political will and investment in a COVID-19 recovery agenda that is gendered and promotes accountability for action. The Trust’s Networks will provide a solid national footprint and jointly work as a collective of actors as an ecosystem for change.

About FinEquity Global

FinEquity Global (convened by CGAP), The Graça Machel Trust (GMT) and FSD Network are excited to launch FinEquity Africa – a regional community of practice (CoP) to advance women’s financial inclusion and promote equitable access to and use of a wide range of financial services across Africa. Please sign up below if you would like to join this community to connect, share, and learn with others. HERE

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

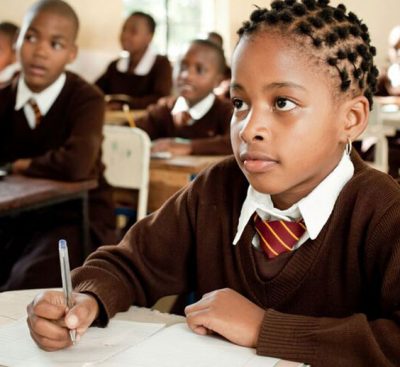

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.