Financial inclusion is critical in breaking the poverty circle for women as it helps them access many forms of credit facilities, help them with saving money, accumulate assets. However, despite the progress being made to improve the status of financial inclusion for women, World Bank reports indicate that there is still a gap between women and men, especially in low- and middle-income economies. “Men are 9 per cent more likely than women to have an account, a gender gap that has stubbornly persisted.” Our financial inclusion studies have also unveiled that women’s experiences in applying for finance are often tedious, very tough, a scam due to the red tape, sketchy and putting a lot of strain on small businesses. This year, the Graça Machel Trust commemorated International Women’s Month by highlighting this critical issue under the theme Breaking the Gender Bias in Finance.

On 10th March, the Trust’s Expert Leaders Group convenor Ms Elsie Addo Awadzi, the Second Deputy Governor of the Bank of Ghana, joined a high-level webinar dialogue hosted by the Toronto Centre. Her reflections on Women’s Leadership in Financial Inclusion and Economic Recovery focused on how financial inclusion helps combat bias and break the barriers to gender equality and the role of monetary authorities in supporting positive change.

Toronto Centre Program Leader, Jennifer Long, moderated the session and highlighted the 2017 Global FinDev survey that revealed a Gender Gap in access to finance, which is still 9 per cent in developing economies. She asked Ms Awadzi, “So can Central Banks and Supervisors make a difference in closing the Gender Gap?” In her response, Elsie Addo Awadzi pointed to the role played by regulators in adding value to the economy. “Regulators need to balance safety and soundness with why we issue licenses to institutions. Whether you look at the game’s rules or the approaches employed, the gender approach is key,” she said. She added that regulators need to start with data, obtain data in a granular way that allows us to assess understanding.

For example, in Ghana, MSMEs constitute 44% of women, and 70% of GDP is contributed is by MSMEs. When women do not have access to finance, how will they be critical engines of growth for the country.” This was echoed by Irene Espinosa Cantellano, Deputy Governor, Bank of Mexico, who shared how Mexico is working towards reducing the gender gap in the financial sector.

How can Regulators help? Key highlights from Elsie Addo Awadzi

“Loan books may look good, the savings account may look good; however, how many makeup women as customers”

- Invest in infrastructure to invest in collecting granular data.

- Look at how many complaints from financial service providers are from women and understand the nature of the complaints.

- Look at online marketplace lenders, and how many of these are attributable to women versus men.

- Enable technical innovation for financial service providers, becoming a fundamental game-changer for digital financial inclusion.

- Create an enabling environment that allows women entrants that are traditionally not permitted into the payments ecosystem as women everywhere have access to a mobile phone which many can access critical financial services these days.

“It takes a lot to calibrate a regulatory regime that allows you to promote safety and soundness in the financial system and financial inclusion and integrity”

Elsie Addo Awadzi is also a member of the Expert Leaders Group (ELG) on Women’s Financial Inclusion in the Digital Economy in Africa under the Graça Machel Trust. The Trust convened the ELG consisting of female Deputy Governors of Central Banks (finance regulators) and senior financial sector leaders to elevate the voices of African women. These priorities help build inclusive economies and institutions that respond to the needs of women. The ELG represents the five regions in Africa and collaborates with the Trusts’ Women’s sector-based Networks to build stronger political will and investment in a COVID-19 recovery agenda that is gendered and promotes accountability for action. The Trust’s Networks will provide a solid national footprint and jointly work as a collective of actors as an ecosystem for change.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

The Trust supports and mobilises civil society networks on issues of ending child marriage, ending violence against children, ending female genital mutilation and promoting children’s rights, to carry out advocacy and action across Africa. Special focus is placed on Malawi, Mozambique, Tanzania and Zambia where child marriage continues to be a problem largely driven by poverty, gender inequality, harmful traditional practices, conflict, low levels of literacy, limited opportunities for girls and weak or non-existent protective and preventive legal frameworks.

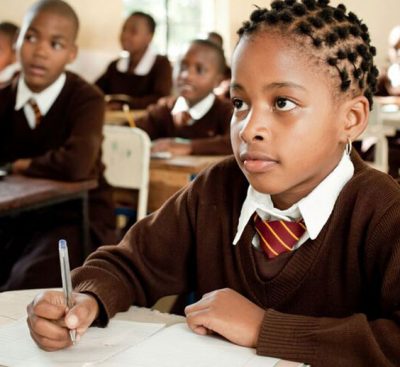

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

Education is a fundamental right for all children, which is also a vehicle for social, economic and political transformation in communities, countries and the African continent at large. Recent studies indicate a lack of progress in some of the critical commitments aimed at improving education quality, access, retention and achievement, particularly for girls. In most African countries, girls may face barriers to learning, especially when they reach post-primary levels of education. By implementing multi-dimensional approaches to education which includes core education, personal development, life skills and economic competencies, the Trust partners with funding partners, governments, civil societies and the private sector to improve education access.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents.

The Nutrition and Reproductive, Maternal, New-born, Child and Adolescent Health and Nutrition, (RMNCAH+N) of the Children’s Rights and Development Programme aims at promoting the Global Strategy for women, children and adolescents’ health within the Sustainable Development Goals (SDG) agenda. The strategy emphasises on the importance of effective country leadership as a common factor across countries making progress in improving the health of women, children and adolescents. Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.

Through its Early Childhood Development (ECD) plan, The Trust will seek to put into action the new science and evidence Report that was presented by Lancet Series on Good and early development – the right of every child. This will be achieved by mobilising like-minded partners to contribute in the new science and evidence to reach all young children with ECD. The Trust’s goal is to be a catalyst for doing things differently, in particular, to rid fragmentation and lack of coordination across ECD sectors. In response to evidence showing the importance of political will in turning the tide against the current poor access and quality of ECD. Even before conception, starting with a mother’s health and social economic conditions, the early years of a child’s life form a fundamental foundation that determines whether a child will survive and thrive optimally.